2023 Market Update

2023 - Return to Normalcy

The market we experienced from mid 2020 to mid 2022 was an unsustainable caffeine high. If the second half of 2022 was crashing from the high, then 2023 should serve as a detox. As with all detoxing, this won’t be smooth. There will likely be some setbacks, but we believe the majority of the market correction is behind us, and we can expect to find more balance this year.

The last market we would consider “normal” was 2019, the last full year we had before Covid. As we look to predict pricing and market momentum, we are drawing comparisons to 2019 instead of 2020/2021 because they were such outliers. Since 2019 was a strong, consistent, and predictable year, I am going to use graphics to show where we were vs where we are now in 3 categories: price, inventory, and showings per listing. And fear not, I will answer your burning questions about the dreaded “R” word… recession.

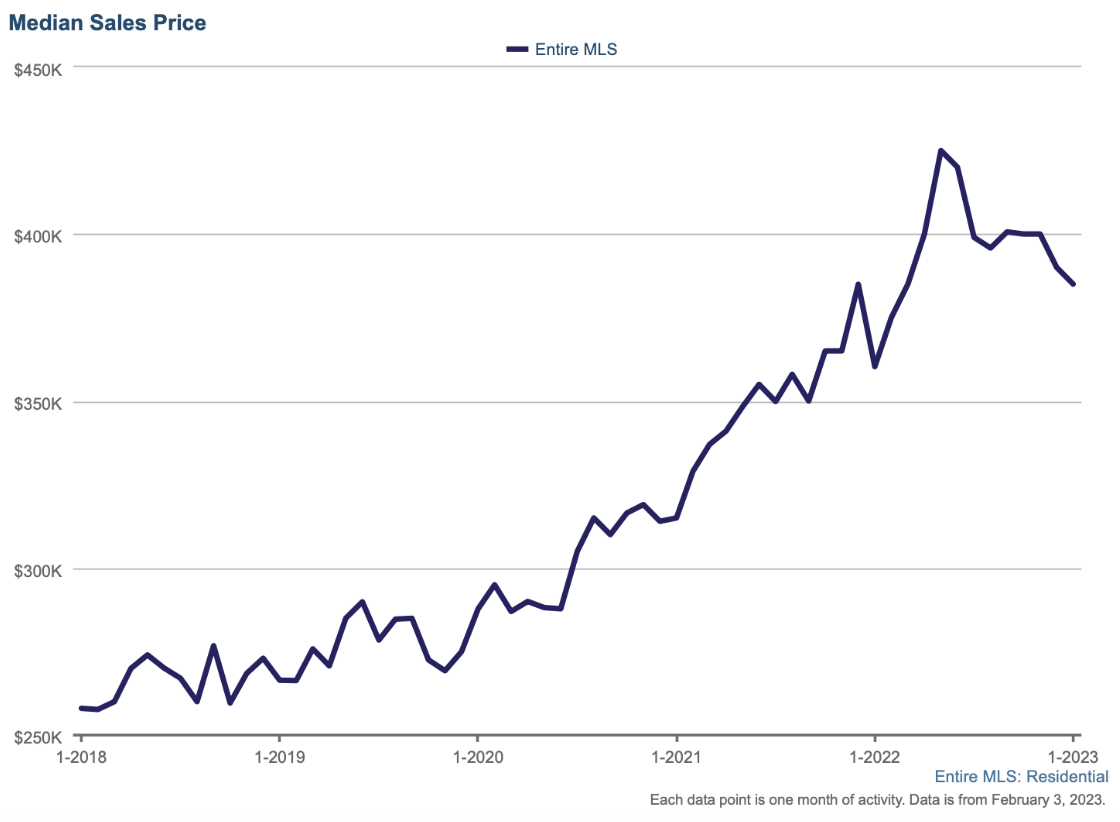

Median Sales Price

The median sales price in Charleston in February 2019 was $266,000. Starting in June of 2020, the median sales price began to skyrocket until it reached a peak in May 2022 of $425,000. Since the peak, the price has dropped slightly and seems to be steady around $390,000, still significantly above where the values were in 2019. Please note that we do not believe this means your home has lost value. This is just a slight market correction and a reflection of homes no longer selling significantly above list price. The 5-10% premium over asking price that buyers were willing to pay to win bidding wars is no longer necessary, so it’s been shaved off the top. Price stabilization at a sustainable growth rate will be a welcome and healthy change for 2023.

Inventory

In February 2019, there were 6,100 homes for sale. Now in early February 2023 there are only 2,550 homes for sale. Our inventory reached a low point in February 2022 with only about 1,000 homes for sale. The inventory rose to a peak of 3,500 listings in October 2022 but has since been declining. We started this year with some of the busiest weeks of January on record. This recent pop of buying activity resulted from a dip in interest rates based on positive economic reports, and it swallowed up a lot of inventory. If 2023 is going to in fact be a “normal” market, the inventory will begin to rise again through the spring and early summer.

However, there are many factors that will likely prevent our inventory from reaching those 6,000 homes for sale numbers again. For one, homeowners who locked into a low 3% interest rate are less likely to sell. They are not going to want to give up their current low interest rate for a bigger mortgage payment on a higher sales price and higher interest rate. New listings taken were down 22% in December 2022 versus December of 2021. Second, demand continues to outpace supply. So far this year, we have experienced multiple offer situations for both our buyers and sellers. Well priced and market-ready listings may not be getting 10 offers like they were in 2021, but they are probably still getting at least 2-3 offers within the first few days on the market. Inventory will not accumulate until demand subsides. This is still very much a sellers market.

Listing Activity

In February 2019, listings were seen by an average of 5 buyers before they sold. They reached a peak a year ago in February 2022 of 11 buyer showings. In February 2023, a listing is seen by an average of 7 buyers. I think this is an interesting statistic to track because it is a great indication of market activity. This chart shows that the market is still “busier” than in the past (2019 and before) even if we are “slower” than 2020 and 2021. In fact, it seems the market is on track to keep getting busier through the first part of 2023.

But wait, what about that recession?

In January we attended the annual Charleston Trident Realtor Association Economic Outlook event with keynote speaker Dr. Joey Von Nesson, a chief economist at the Darla Moore School of Business at University of South Carolina. Dr. Von Nesson delighted the crowd with an overall positive economic outlook message. He believes 2023 will be a year of readjustment and that most of the market correction and interest rate hikes are now behind us. Inflation appears to have peaked in June of 2022 which should allow the Fed to cool off on interest rate hikes. Dr. Von Nesson believes the chance of a recession this year is only about 50%. If we do see a recession it will occur in the 2nd or 3rd quarter and we will recover by the end of the year. The recession would be very mild because the job market remains strong, especially in South Carolina. The southeast is still projected to see the biggest population growth over the next 40 years. Industries like manufacturing and logistics will follow that growth. Dr. Von Nesson said “There are a lot of reasons to remain bullish about the market moving forward. The long run looks incredibly bright!”